Zakat is an obligation for all Muslims and is one of the pillars of Islam. Once a Muslim is self-sufficient and past puberty, they are obliged to give away part of their money to charity for the sake of Allah. Paying Zakat can be confusing, especially if you have just started doing so, as there are many variables to consider. To get help, you can visit your local mosque and talk to someone, but if that is not an option you can also use a Zakat calculator.

- There are several Zakat calculators available online such as:

- Islamic Relief

- Islamic Help

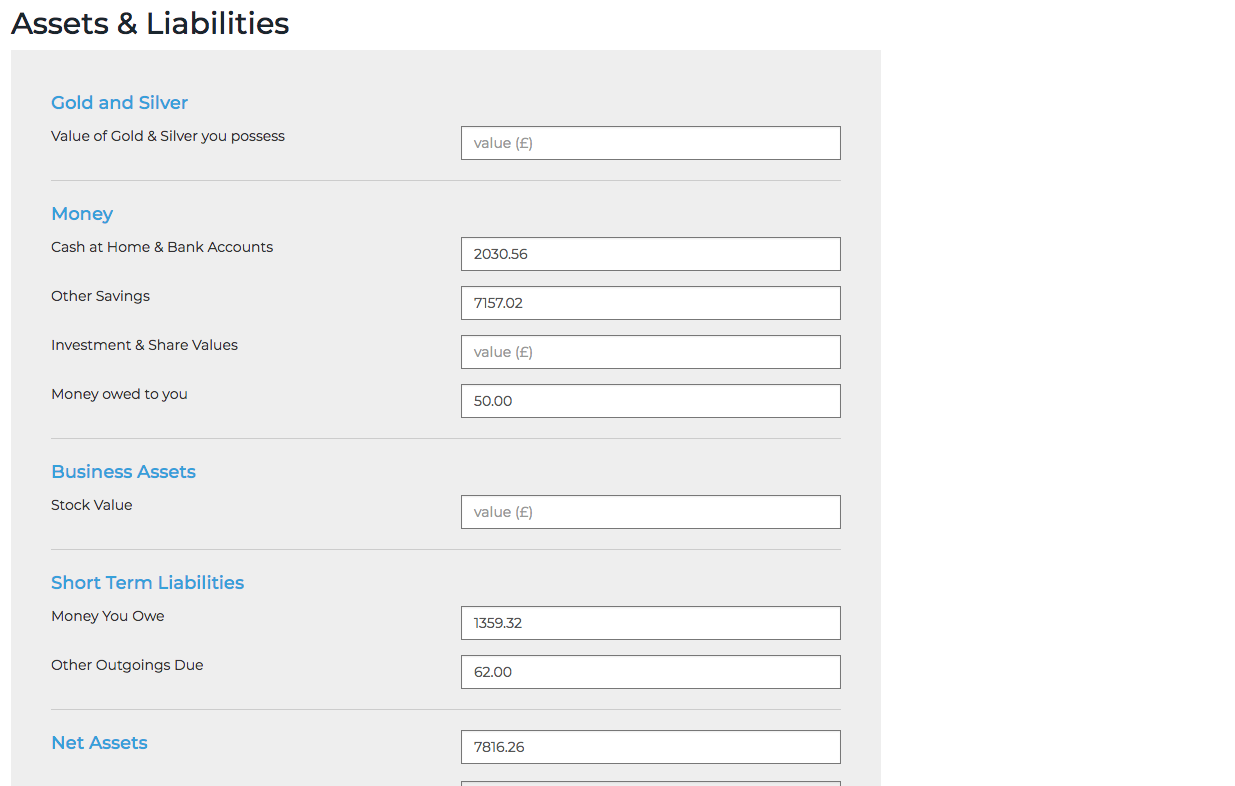

Each year a threshold is set, which is called the nisab. There is a nisab for both gold and silver, with gold having a higher threshold. However today we follow the nisab threshold for silver, as it means more money can be spent on the needy; this year the nisab equates to approximately £267.00. Once you reach this threshold, you must pay 2.5% of your total wealth in Zakat. This covers everything from gold, silver, earnings, and any other assets you own. Here is a guide on what each category means and how to calculate it. Though every online calculator is slightly different, they should all reach the same result. Nonetheless, in this instance we shall be focusing on the Islamic Relief Zakat calculator. As you fill in the form the “Total Amount Liable for Zakat” will automatically update.

- Gold and Silver

During the time of the Prophet Muhammed (pbuh) the form of currency was gold and silver coins, hence the threshold originally being in the form of Dinars and Dirhams. To work out the value of your jewellery, weigh your silver and gold separately then work out what the amount would be in exchange for real money. You can find out the price of gold and silver per gram online. Below is a link for each:

Current Silver Price UK in GBP per Gram

Add these two prices together to find out how much your jewellery is worth. If your jewellery happens to have diamonds and other precious stones in them, take them to a specialist who can accurately tell you how much the gold or silver would weigh without them. If your items are a mixture of metals, some scholars agree that if an item is more than 50% gold or silver, you should pay Zakat on the entire weight.

- Money

Although there are many categories in this section, it is really quite simple. “Cash at Home & Bank Accounts” and “Other Savings” includes any physical money you have, any money in your bank accounts, as well as any other savings such as your pension if you have made any voluntary contributions. Any interest you have accumulated in your accounts should not be entered, as interest is haraam.

“Investment & Share Values” refers to anything you’ve invested in with the purpose of reselling and making a profit. If your shares are an investment to deliver dividends, instead of trading, then only count these dividends. Similarly if you own property as an investment and are therefore receiving rent, only include the profit you are making. On the other hand, if you intend to resell your property input the entire value.

If you have borrowed money to anyone and can foresee it definitely being paid back in within the lunar year, add this amount in “Money owed to you”. However, if you are unsure when and if you will be repaid, only include it in the year you are actually given the money back. Any sum you have partly received can be added in this section.

- Business Assets

If you own a business this is an important section. “Stock Value” is all stock that you have, such as raw materials and goods for sale. Any land and real estate you have with the intention of reselling, should also be part of your stock value. The buildings, machinery, and vehicles that are integral to the business are exempt. Calculate your stock based on market value, not the buying price.

- Short Term Liabilities

“Money You Owe” and “Other Outgoings Due” are essentially any bills, rent, taxes that you still need to pay off that year. If for example you are going on Hajj that year and are intending to pay for some of it off soon, you can add this to “Other Outgoings Due”. But if your money for Hajj is in your savings and you will not be going shortly, this will not be classed as a liability. The amount entered in this section will be deducted from your “net assets”, therefore giving you less to pay in zakat.

Once the entire form is filled in, you will find how much you owe at the bottom of the page. You can choose to donate the money to an Islamic charity or give it to a person in need directly.

Below are some frequently asked questions regarding Zakat.

FAQ

- 1. When do I pay Zakat?

Following one lunar year (354 days) after you first reach the threshold and become eligible, you will have to pay Zakat. If you drop below the nisab threshold during this time, but are above it by the end of the lunar year, Zakat will still be payable.

- 2. I want to make up for the previous years I didn’t pay Zakat, is that possible?

Yes, this is entirely possible. Look back over your bank statements and combine your total wealth (including jewellery etc.) over the end of each lunar year you missed. Calculate 2.5% of this sum to find how much you owe in Zakat. For example, let’s say you missed two years of giving Zakat. In one year you earned £4,000 and another you earned £6,000. You’d add these two figures together, then multiple it by 0.025 to calculate how much you are liable for (10,000 x 0.025 = £250). If you're unsure about how much you earned in each year, you can make a rough estimate.

- 3. Do I have to pay Zakat on my house, car, laptop etc?

No you don’t have to pay Zakat on such possessions.

- 4. I have a mortgage and student loans to pay off. Should they be included in “Money You Owe”?

In general, the whole sum of long-term debts are not seen as a deductible as it is not expected to be paid straight away and it's typically such a large amount, that adding it would leave the payer with £0 in assets. However it is permissible to add the installments for your mortgage that is yet to be paid that year. Not everyone agrees with this, so it is best to speak to a scholar or imaam about a specific issue you have.

- 5. Who can I pay Zakat to?

- According to the Qur’an, Zakat money can be given to:

- - The poor

- - The needy

- - Zakat collectors

- - New reverts of Islam

- - Slaves (in order to free them)

- - People in debt

- - A traveller

- - Something for the cause of Allah

- The money cannot be spent on:

- - Lineal descendants, ascendants and spouses (children, grandchildren, parents and grandparents)

- - Rich people

- - Non-Muslims

- - Buildings, equipment, wells etc.

- - Dawah purposes

The reason for the final two is because one of the stipulations to giving Zakat is that the money should be a direct transfer of ownership from the Zakat payer to the Zakat recipient (Tamleek).

- 6. Can I pay Zakat on behalf of others?

You can pay Zakat on behalf of others, such as your spouse or parents, as long as they give you full consent in advance.

Назад в новостиThe application for

edits point accepted

Edits will be added

after verification, you

there will come a notification

in the personal Cabinet